Inexpensive letters of protection are available for cars, motorcycles and camping vehicles. Before committing yourself as a driver, a few questions should first be clarified: What do I want to protect? Is it just about protection in the event of a breakdown or an accident? A mobility guarantee like that offered by many car manufacturers with regular maintenance and inspections in their own workshops? Or do I want more: legal advice, used car inspection? What about a foreign span? Do I travel a lot by car and therefore need Europe-wide protection, vehicle return transport or spare parts transport?

Who should be protected? Should only one vehicle and the people in it be secured or do I want protection independent of the vehicle – for the partner and the children as well as my own car?

What does the protection do? Here it is important to take a close look and critically examine the services: Are there, for example, upper limits up to which the costs will be covered? Are the costs of an overnight stay covered in the event of a breakdown? At what distance from the place of residence does the letter of protection apply? How quickly can breakdown helpers be on site?

In addition to automobile clubs, many insurers offer motor vehicle protection letters, which come into play in the event of accidents, breakdowns or illness on vacation, including HUK-COBURG. Their letters of protection cost between six and twelve euros a year, depending on the type of vehicle – car, motorcycle or camping vehicle.

Among other things, fast help around the clock in the event of an accident or breakdown thanks to our own emergency call center, protection when traveling and driving to work or shopping, medical repatriation in the event of accidents from 50 kilometers from the place of residence and further help in many emergencies when travelling, for example spare parts, are covered – and drug shipping as well as the organization of a rental car, help in natural disasters and much more such as patient repatriation.

Protection letter from the club or from the insurer?

Not only because of current events, vehicle owners are often looking for alternatives to the letters of protection from automobile clubs. They want the security of the letters of protection without having to become a member of an association. The car insurers have developed vehicle protection letters for them, which are offered as extras to the normal car policies.

These additional breakdown and accident assistance offers as an additional component of the car insurance are often noticeably cheaper than the offers of the clubs with comparable services. Therefore, consumer advisors recommend comparing the different prices and services of the insurers with those of the automobile clubs before concluding such a contract. Especially when it comes to the protection letter alone, the car insurers usually offer the cheaper alternative.

The protection letter customer should therefore weigh up which assistance he personally values. Because there are some clear differences here. In terms of basic content, however, the letters of protection from insurance providers hardly differ from those from automobile clubs: basic protection includes rapid assistance in the event of an accident or breakdown, and the recovery or towing of the vehicle. Other common services include repatriation and emergency assistance while traveling. An emergency call center is usually available around the clock for this purpose. Other services can be arranged on request at an additional cost.

With these additional services, the letters of protection then vary considerably in some cases. Here the protection letter customer should take a closer look, advise consumer advocates. It is important to clarify, for example, the maximum amount of costs that may be covered. Another criterion to be considered is the area of validity of the protection letter – Germany or Europe? It is also necessary to check whether the driver or the vehicle is insured and to what extent the agreed benefits also apply to fellow travelers.

In order to be able to provide quick help on site if necessary, the large motor vehicle insurers now also have assistance services. They, too, are increasingly proving to be angels of salvation.

Abroad

The majority of Germans use their car for vacation trips – regardless of whether the travel destination is in Germany or abroad, such as Spain, Italy or Croatia. Around 26.4 million vehicle owners have a motor vehicle protection letter from the German insurer on board. According to the General Association of the German Insurance Industry (GDV), they receive quick and uncomplicated help in the event of a breakdown or an accident at home or abroad.

According to the association, German motor insurers rely on an average of 7,000 breakdown and towing companies throughout Europe for breakdown and accident assistance.

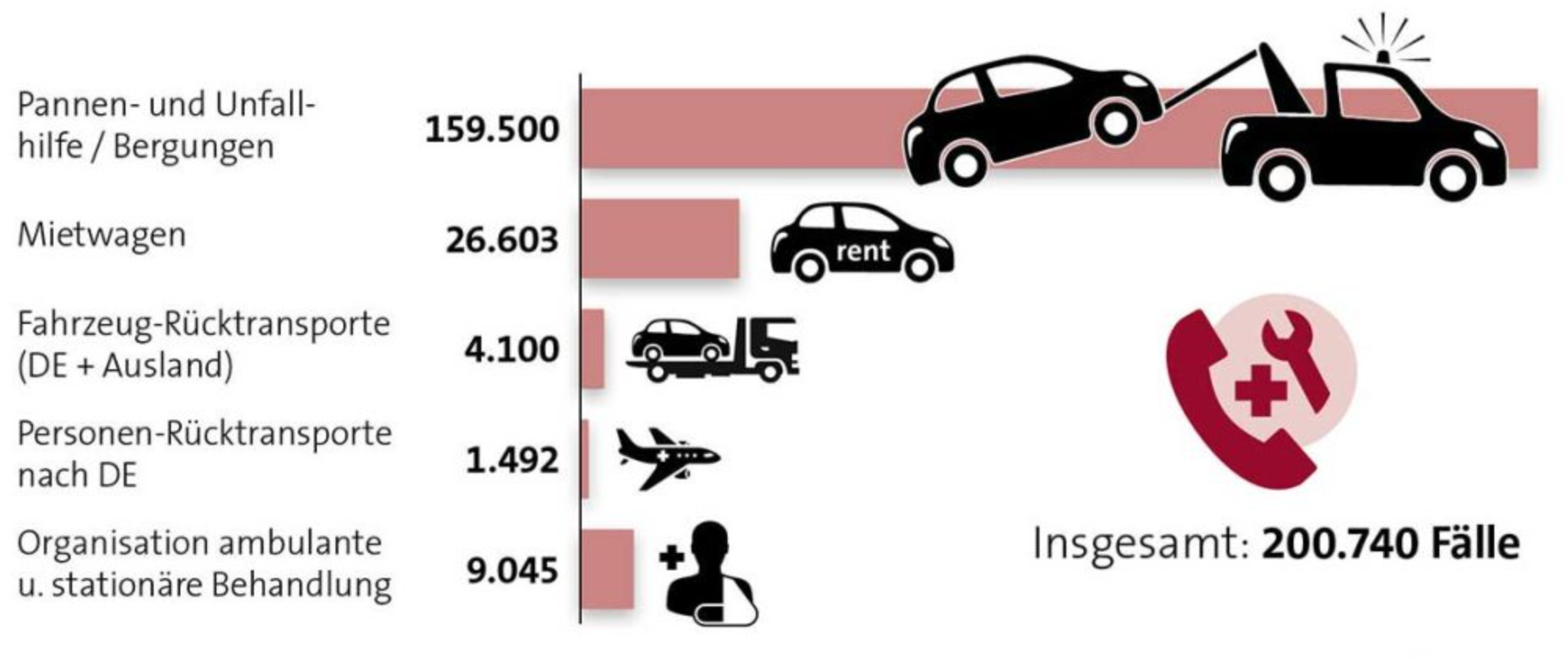

In the travel season from June to August, the insured made use of the motor vehicle services of the protection letter in over 200,000 cases. Accident and breakdown assistance predominates. In around 160,000 cases, the assistance letter insurers helped their customers with a breakdown or an accident in the summer months. Overall, motor vehicle insurers organized over 540,000 breakdown service calls last year.

The clear majority of car protection letters offer insurance protection in Germany and in other European countries. The letter of protection is often very helpful, especially abroad, as it is usually more difficult to organize quick help there. In addition, many services are specially tailored to the stay abroad. This includes the return transport of vehicles and people. Last summer alone, motor insurers returned 4,100 vehicles to their home town. In addition, according to the GDV, 1,500 accidentally injured or sick people were transported back to Germany.

The car protection letter is an additional module for motor vehicle insurance, which is expressly included in the contract. It is usually locked for the vehicle and is therefore driver-independent. As a rule, there are already letters of protection in the lower two-digit euro range.